Investors will have to step in and buy about €300bn more eurozone government debt next year to prevent market turmoil as the European Central Bank starts to cut its vast bond holdings, analysts have warned.

The ECB is due to outline plans to shrink its €5tn bond portfolio on Thursday, alongside an increase in interest rates of at least 0.5 percentage points to 2 per cent, as it steps up its efforts to tame soaring inflation by tightening credit conditions.

The central bank’s plan to cut its support for sovereign bond markets comes as eurozone governments are set to issue more debt next year to cover the cost of shielding households and businesses from the impact of high energy prices this year.

Analysts say member states’ increased debt issuance, coupled with less bond buying from the central bank, could revive concerns over whether the high debt levels of some countries are sustainable and spark fears of a repeat of the region’s 2012 sovereign debt crisis.

“Debt sustainability concerns could resurface [in countries such as Italy] as interest rates rise further and the ECB shifts from net bond buying to selling,” said Veronika Roharova, head of euro area economics at Swiss bank Credit Suisse.

Governments in the 19-country euro area are expected to increase the amount of debt they issue from €1.1tn this year to about €1.3tn next year, according to Pictet Wealth Management. The ECB, meanwhile, is expected to reduce its bond purchases by about €300bn compared with this year, according to Pictet.

Ludovic Subran, chief economist at the German insurer Allianz, warned about a repeat of tensions that flared in 2012. “We could see another test of European solidarity, with very little growth prospects, high debt and rising interest rates,” he said.

Analysts at ING said the amount of eurozone government debt likely to go on sale to private investors would rise from about €200bn this year to above €500bn next year. Konstantin Veit, a portfolio manager at Pimco, an investor, estimated the figure could hit €600bn next year.

“Markets will have some difficulties initially absorbing the significant amount of bond supply without the ECB in the market,” said Piet Haines Christiansen, a strategist at Danske Bank in Denmark.

“There is some degree of complacency,” said Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management. “We may be just one shock away from a sharp rise in bond yields.”

On Thursday, the ECB is due to lay out the principles for starting to reduce the portfolio of government and corporate bonds it has accumulated since early 2015 — a process known as quantitative tightening. It stopped buying more bonds in July, but has been reinvesting any proceeds of maturing securities since then.

Because of concern about how debt markets might react to the move, the ECB is expected to say it will begin the process gradually, by only reinvesting marginally less of the proceeds from bonds that mature than it does at present.

Germany’s central bank boss Joachim Nagel has called for an early and aggressive stop to reinvestments in the first quarter, but others urge caution and the slowdown is expected to begin only in the second quarter of 2023.

The exact timing is unlikely to be finalised until early next year.

The US Federal Reserve already started a runoff of its bond portfolio in June. The Bank of England has gone further by actively selling bonds before they mature — something the ECB is not expected to do for several years.

“The question of debt sustainability is always lurking somewhere just below the surface in Europe,” said Daleep Singh, chief economist at PGIM Fixed Income, an investor. “The ECB is appropriately going to tread very carefully.”

In total, analysts expect the ECB to reinvest about half the €350bn it receives from bonds maturing next year in its €3.3tn asset purchase programme, which is the central bank’s largest QE scheme. It is due to continue reinvestments in a separate €1.7tn pandemic emergency purchase portfolio until at least the end of 2024.

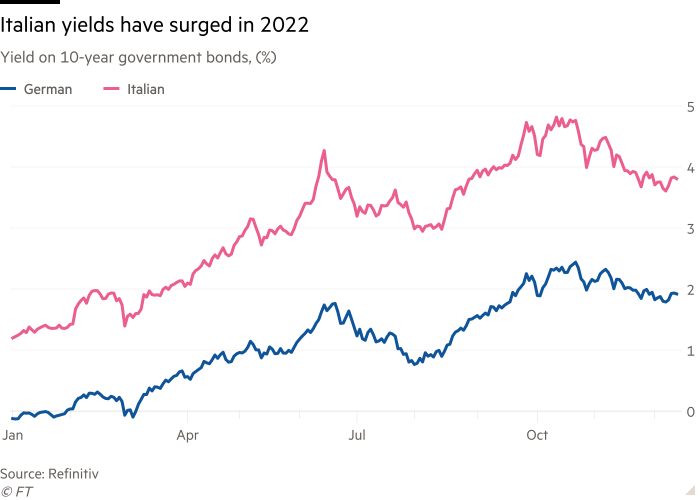

The biggest concern for many investors is Italy, where government debt levels are among the highest in the eurozone at close to 150 per cent of gross domestic product. Italian 10-year bond yields have fallen in recent weeks, but at 3.8 per cent they are still over three times higher than they were at the start of the year.

Sven Jari Stehn, head of European economics at US investment bank Goldman Sachs, said the country’s new rightwing coalition government led by Giorgia Meloni was “on a narrow fiscal path”. High debt levels, weak growth and interest costs that hit 4 per cent of gross domestic product this year are “highlighting medium-run fiscal vulnerabilities”, he said.