U.S. tech stocks have been a minefield for investors this year, but hedge fund manager Dan Niles...

Global

It’s been a year of bad news, including record-high inflation, a crippling energy crisis, and a war...

Traders are warning that thin volumes and erratic trading have disconnected the price of nickel on the...

Most Australian businesses are planning to invest in the metaverse in the coming months to enhance customer...

Facebook Twitter LinkedIn If you’re a B2B marketer working for a multinational company with corporate and geomarketing...

Big mutual fund companies don’t make bold calls often. So when they do, like Vanguard just did,...

Inflation has started to show signs of easing from the multi-decade highs reached in many countries following...

Australia’s central lender astonished markets in early Oct with a more compact-than-envisioned rate hike, a transfer the...

Global stocks slipped last week, but some beat the market. The MSCI World index was down 1.69%...

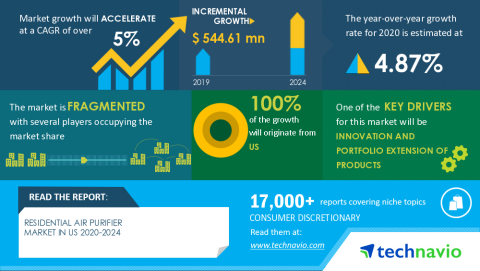

The residential air purifier market is expected to grow by USD 544.61 million, progressing at a CAGR...

iCrowdNewswire Jan 25, 2021 9:00 AM ET MarketandResearch.biz has recently published a research report titled Global Big Data...

The implication is that it’s not sufficient to give consideration to average outcomes to assess challenges in...