Phase One Trade Deal: What It Means for the Global Market in a world increasingly defined by...

Business & Finance

China-US Tariff Deal Explained: Winners, Losers, and What’s Next in the ever-volatile landscape of global commerce, few...

Financial Literacy Made Simple: What You Need to Know in an age defined by economic flux, digital...

10 Budgeting Tips That Actually Work managing money isn’t just about saving a few bucks—it’s about transforming...

Tariffs and Inflation: What’s the Connection? in a world increasingly driven by global trade, two economic terms...

International Tariff Laws: A Global Overview in a world defined by interconnected economies and intricate trade networks,...

Biden’s Strategy to Defeat Trump in 2024 the stage is set, the players are known, and the...

Biden vs Trump: What You Need to Know for 2024 the stage is set. The battle lines...

Forbes announced Tuesday the promotions of two Forbes veterans to chief revenue officer and chief digital and...

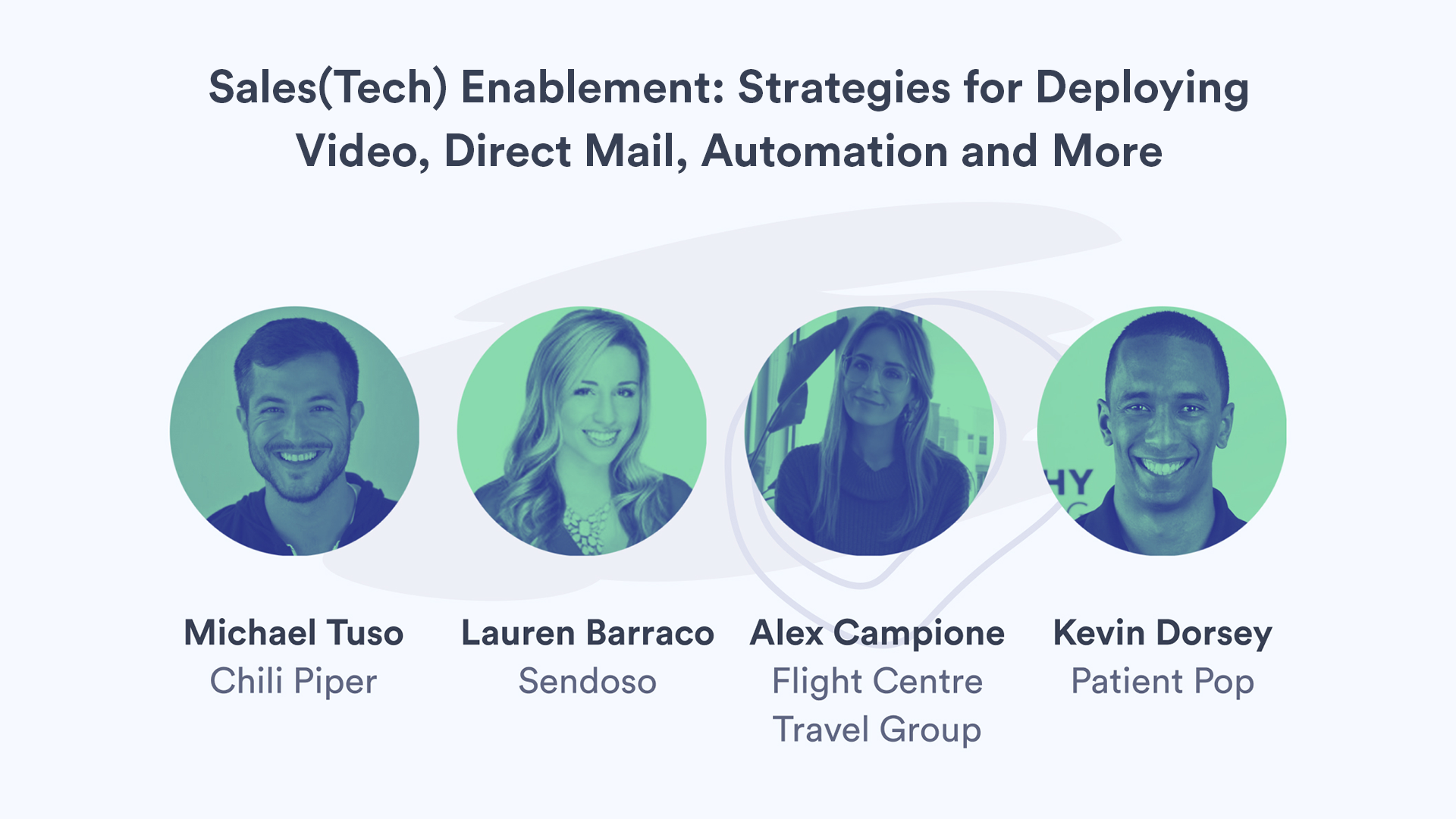

January 12, 2022·4 min read Got your team on board with using video? Now it’s time to...

By Kelsey Johnson December 12, 2022 All AWeber accounts come with an easy LinkTree alternative. It’s beautiful,...

June 10, 2022·8 min read Secure video is a must for any financial services organization. Learn how...