Federal authorities on Tuesday charged FTX co-founder Sam Bankman-Fried with using what they said was tens of...

Finance

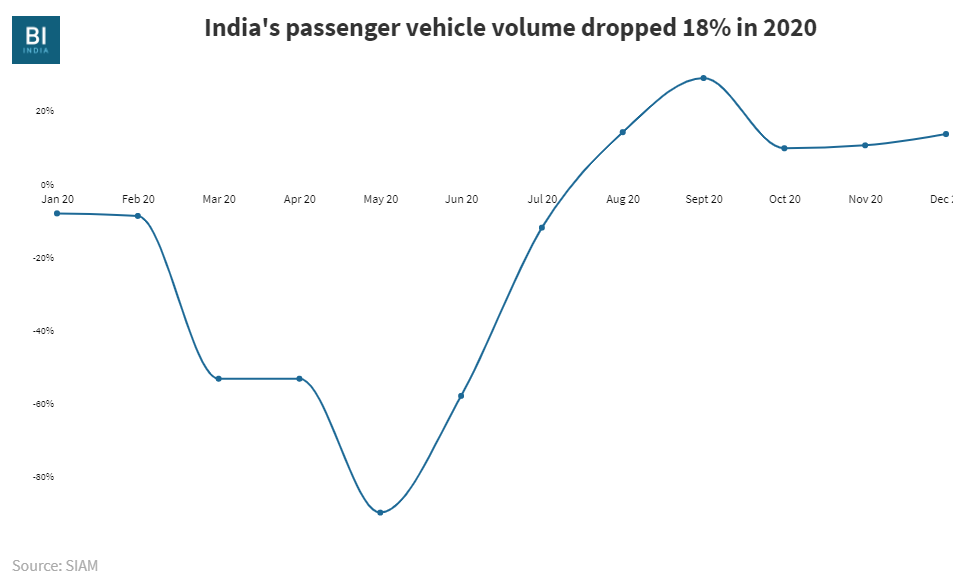

In the year when billionaire Elon Musk-led Tesla is planning to enter India, the EV will be...

………. ………. ………. ………. ………. ………. ………. ………. ………. ………. ………. ………. ………. ………. ………. ………. ………....

We’ll start with the business owners, many of whom are first technology entrepreneurs with little business expertise...

Stakeholders may withdraw their investments when forecasts show lower than promising financial and risk is elevated. You...

Figuring out how a lot you need—and how lengthy of a reimbursement time period you need—will be...

IBF was based by a small group of registered representatives and financial planners. As a outcome I...

The unique funds you or others put into the business to start out it, counts towards your...

The kinds of businesses that hire for these positions embrace banks, consulting companies, accounting firms, government treasury...

Meet together with your utility friends to debate present issues in human assets and training. Come prepared...

The lab is staffed with MS Finance students to assist students navigate the Bloomberg Terminal and are...

Claims adjusters, appraisers, examiners and investigators additionally authorize funds and hold all claims files on document. States...